OUR MISSION

About Us

Foster and facilitate sustainable economic developments and business ventures in tribal and adjoining rural communities.

We are a 501 (c)(3) nonprofit organization and Native Community Development Financial Institution (CDFI). We provide education, training, and direct lending of money to support local and regional economic and community development efforts, with emphasis on the Jamestown S’Klallam Tribe and its citizens as well as underserved people and residents of the Olympic Peninsula.

We provide small business, microenterprise, and consumer (credit builder) loans, which are either unsecured or secured by marine vessels (fishing boats), equipment, vehicles or other personal property. We are not mortgage lenders nor do we take real estate as collateral.

JST Capital fulfills its mission through loans and development services for:

- Financially distressed individuals.

- Small and startup businesses that do not typically qualify for traditional financing.

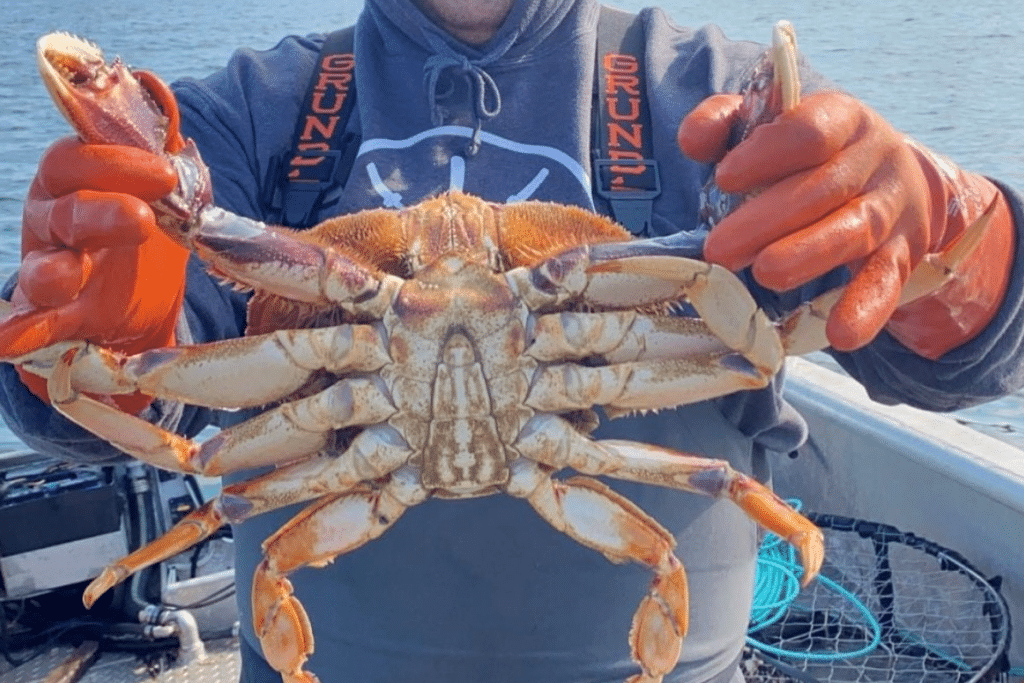

- Tribal commercial enterprises such as fisheries, seafood, and forestry industries.

- Businesses focused on creating jobs, supporting entrepreneurship, and community development.

Equal Opportunity for All

To file a complaint of discrimination, write to:

U.S. Department of the Treasury, Director, Office of Civil Rights and Equal Employment Opportunity 1500 Pennsylvania Avenue, N.W., Washington, DC 20220; or send an e-mail to:crcomplaints@treasury.gov.

What We Do

Provide loans and services to individuals and small businesses that improve the financial well-being of tribal people and enterprises, as well as others in the rural surrounding communities of the Olympic Peninsula.

Our Principals:

- We are a long-term investor;

- We believe that relationships matter;

- We value independent thinking;

- We are a conviction-based business;

- We are a flexible and nimble partner;

- We are intellectually curious; and

- We align JST Capital’s interests with the interests of our partners.

Our Board

Rochelle Blankenship, Chairman

Rochelle was appointed to the Tribal Council Secretary position in January 2020 and elected November 2020. She graduated with honors receiving her Masters of Business Administration in 2016. Currently, she is the Executive Director for the Tribal Gaming Agency. She has served as Secretary for the Jamestown Higher Education Committee since 2013. Rochelle is also a Board Member on the Jamestown Economic Development Board. Being passionate about Safety and Law and Order, she represents Jamestown on the Clallam County Sheriff Citizen Advisory Committee, as well as on the Port Angeles Safety Advisory Committee. Additionally, Rochelle serves on the Board of Washington Association of Tribal Regulators as Secretary to help keep Jamestown on the cutting edge of important changes in regulations in gaming.

Laura Lee (Laurie) Stewart

Ms. Stewart is the President and CEO of Sound Community Bank headquartered in Seattle Washington. Prior to Sound, Ms. Stewart was a senior executive at Great Western Bank. She is a frequent speaker at conferences and colleges and has testified in both Washington DC and the Washington State Legislature on financial services issues.

Jeff Allen

Jeff is a tribal citizen and has a long career in banking. He has served as a Tribal Gaming Commissioner since 1995 and has served as a Tribal Council Member as well.

Hawk Grinnell

Hawk Grinnell is a Jamestown Tribal Citizen who has worked at the Jamestown EDA since 2015. His CPA experience has helped the EDA, a Tribal political subdivision, grow and take on new ventures. Hawk has proven that good decisions start with good financial data. This has laid the foundation for many successful EDA businesses over the years. “The Tribe’s businesses are well taken care of thanks to the EDA’s staff. I raise my hands in thankfulness for their hard work.

Who We Serve

Financially distressed individuals

Small and startup businesses

Tribal commercial enterprises

Businesses focused on creating jobs

Our Services

Featured Services

Loans to entrepreneurs and small businesses, or instead refer potential borrowers to other lenders or traditional sources of financing.

Personal, education and emergency loans are available to enrolled citizens of the Jamestown S’Klallam Tribe, descendants and employes of the Jamestown S’Klallam Tribe.

In conjunction with our lending services, we assist our clients exploring business ideas. We also provide education and counseling on building credit.

Our Supporters

JST Capital’s priority is to provide investment capital into the community where we live, work, and play. As a non-profit 501 (c)(3) corporation, we rely on outside investors to support our success reinvesting in the community. The acquisition of capital for operating and lending is limited.